The smart Trick of Estate Planning Attorney That Nobody is Discussing

The smart Trick of Estate Planning Attorney That Nobody is Discussing

Blog Article

Getting The Estate Planning Attorney To Work

Table of ContentsEstate Planning Attorney Can Be Fun For AnyoneThe Single Strategy To Use For Estate Planning AttorneyOur Estate Planning Attorney IdeasThe 6-Second Trick For Estate Planning Attorney

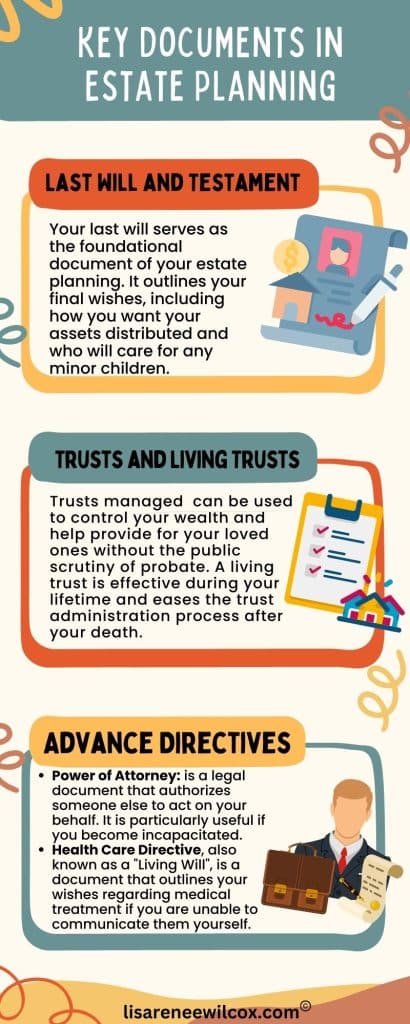

Estate preparation is an action plan you can make use of to determine what occurs to your properties and commitments while you live and after you die. A will, on the various other hand, is a lawful document that details how possessions are dispersed, that deals with children and pet dogs, and any other desires after you pass away.

The administrator likewise needs to pay off any kind of taxes and financial debt owed by the deceased from the estate. Lenders usually have a restricted amount of time from the date they were alerted of the testator's fatality to make claims versus the estate for money owed to them. Cases that are rejected by the executor can be taken to court where a probate court will have the final say regarding whether the insurance claim stands.

Get This Report on Estate Planning Attorney

After the supply of the estate has actually been taken, the value of possessions determined, and tax obligations and financial debt repaid, the administrator will then seek authorization from the court to distribute whatever is left of the estate to the beneficiaries. Any type of estate tax obligations that are pending will certainly come due within 9 months of the day of fatality.

Each private locations their possessions in the depend on and names a person various other than their spouse as the beneficiary., to support grandchildrens' education.

Estate Planning Attorney Things To Know Before You Get This

This approach entails freezing the worth go to my blog of a possession at its value on the day of transfer. Accordingly, the quantity of possible funding gain at fatality is likewise iced up, enabling the estate organizer to estimate their prospective tax obligation upon fatality and much better prepare for the repayment of revenue taxes.

If enough insurance coverage profits are available and the plans are properly structured, any kind of earnings tax on the regarded dispositions of possessions following the death of a person can be paid without turning to the sale of properties. Proceeds from life insurance coverage that are received by the beneficiaries upon the fatality of the guaranteed are generally earnings tax-free.

There are particular documents you'll need as part of the estate planning process. Some of the most typical ones consist of wills, powers of lawyer (POAs), guardianship classifications, and living wills.

There is a misconception that estate planning is just for high-net-worth people. That's not true. Estate preparation is a device that everyone can use. Estate planning makes it much easier for people to establish their wishes prior to and after they pass away. In contrast to what lots of people think, it extends beyond what to do with assets and liabilities.

The Only Guide for Estate Planning Attorney

You need to begin preparing for your estate as quickly as you have any kind of quantifiable asset base. It's a recurring procedure: as life proceeds, your estate plan should move to match useful link your situations, in line with your brand-new objectives. And keep at it. Refraining your estate planning can cause unnecessary financial worries to enjoyed ones.

Estate preparation is often thought of as a device for the wealthy. Estate planning is likewise a wonderful way for you to lay out plans for the treatment of your minor kids and look here family pets and to detail your wishes for your funeral and preferred charities.

Eligible candidates who pass the exam will be formally certified in August. If you're qualified to rest for the examination from a previous application, you might file the brief application.

Report this page